Contents:

The “QBO” window’s “Payroll” tab should be selected. Choose the vendor name whom you will be submitting these 401 payments to, such as Charles Schwab, or the like. Let me share some details about this removal of deduction. Allow me to point you in the right direction to make a one-time contribution. Go to the Payroll menu in your QuickBooks Online account. I appreciate your prompt reply and for going through the steps shared by my colleagues above, @spmorin.

You will see any reports QuickBooks Online can generate for your business. For example, if your business does not have multiple worksites, you will not see the multiple worksites report. QuickBooks Online screens and automates information for your business, so it does not give you any unnecessary reports. Payroll tax and wage summaries outline both federal and state taxable wages. Payroll billing summaries give a history of all payroll charges billed to your business.

The Best Online Payroll Companies and Software Reviews of 2023 … – Business.com

The Best Online Payroll Companies and Software Reviews of 2023 ….

Posted: Mon, 17 Apr 2023 07:00:00 GMT [source]

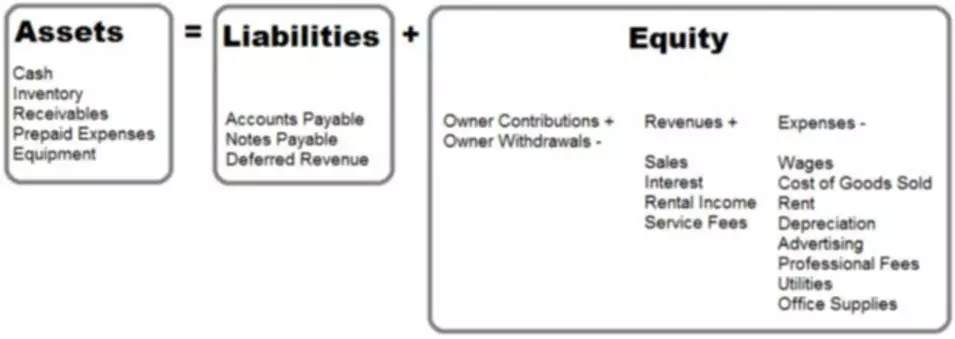

If you’re overwhelmed with the many aspects of learning how to do payroll accounting, you’re not alone. It’s important to choose a quality accounting program that will make documenting transactions easier. You’ll thank yourself when an audit arises or you just need to prepare an income or cash flow statement at year-end. Most companies do it at least monthly and definitely at year-end. When you or your bookkeeper goes to close the books for November, $700 will need to be recorded as a credit to be paid in your accrued payroll account.

How to Set Up 401K in QuickBooks Desktop Payroll?

Once all the requirements are met then employees are allowed to elect a plan and start contributing. You can use the Direct Connect Option by enrolling for the Direct Connect service which will allow you access to the small business online banking option at bankofamerica.com. This feature allows you to share bills, payments, information, and much more. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business.

Retirement Plans From Around the World – Investopedia

Retirement Plans From Around the World.

Posted: Sun, 26 Mar 2017 03:03:17 GMT [source]

Many of these reports can be customized to fit your data reporting. Workers’ compensation reports show payroll classifications and premiums. Multiple worksite reports depend on the state in which you conduct business, but they include information related to completing multiple worksites. Learning how to record IRA contributions in Quickbooks is a straightforward process.

Method One: EZ Setup

It is not necessary to use the employee’s name, if you need detail on employee’s wages, your reference will be the payroll reports produced by the payroll service company. A 401K plan is a retirement plan for benefiting the employees. Here, a part of the employee’s earnings is contributed by the employer.

A 401k is a retirement plan in which an employee contributes a portion of her wages. A company often contributes its own money toward an employee’s 401k plan to add to the employee’s contribution as a benefit to the employee. While the employee’s contribution is part of the company’s wages expense, the additional amount the company contributes is a 401k expense for the company. As the employer, you can record a journal entry for 401k expense to reflect the amount your company will contribute for a payroll period.

However, after several years of urging the IRS to reconsider, industry practitioners were able to convince them. On January 18, 2017, the IRS issued proposed regulations that now permit the use of forfeitures to offset all of these types of contributions. S Corp owners with more than 2% ownership do not qualify to participate in this plan. Plans that favor highly compensated or key employees require special attention -see your tax advisor.

- Once done following these steps, your setup for employer match will be finished.

- It generally includes an effective date, a debit amount, and a credit amount.

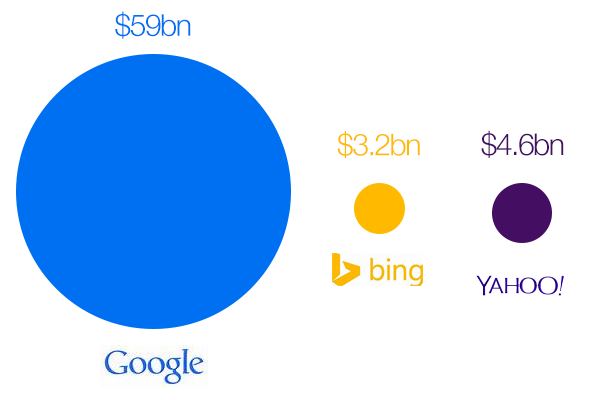

- QuickBooks is the No. 1 online payroll provider for small businesses.

- And, yes, that means that former employees who have already received distributions may be entitled to additional allocations.

- The best way to answer this question is with an example.

- In case you deal your own particular payroll expenses, the aggregate you pay to your payroll provider is less than your compensation cost in perspective of worker deductions.

The above information has provided you the bookkeeping related to how to set up 401k in QuickBooks. If you are new to this accounting software and have no idea how to set up 401k in QuickBooks, then this article will help you. Choose the account you wish to track company match items under the Expense account column. Select Next after entering the name of the deduction or company matching item. If your employer offers a match, click the drop-down option next to Company Contribution and decide how you wish to determine the amount.

QuickBooks Support

This way you can finish setting up payroll items for your retirement plan deductions. In case your deduction amount varies for a few employees then you should access the profiles of those selected employees and modify the deduction amount manually. A 401k plan is a type of qualified plan in which an employer contributes a portion of the paycheck of employees to the retirement savings account.

We are here to resolve all your accounting and financial software glitches with our professional team all around the clock. Click the Edit button, and verify that the payroll element has all of the Vendor’s important details. Accrue the expense directly into a Payroll Liability account; later, you pay that liability. In case you are still facing trouble with QuickBooks Payroll 401, you can reach us on QuickBooks Enterprise Support Number. We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries. We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time.

For example, workers’ compensation is recognized as an expense once the time period that the premium covers has elapsed. At that time, if the payment has not been made, the amount becomes a debt and should be recorded as a liability until it’s paid to the insurance provider. Once done creating the payroll item, you can edit the payroll item in order to make the important vendor details that have been mentioned. It is also important to change or adjust the preset tax settings.

Cost of Annuities: Understanding Hidden Fees – Investopedia

Cost of Annuities: Understanding Hidden Fees.

Posted: Sat, 25 Mar 2017 07:27:43 GMT [source]

This perk may provide financial support to such employees after retirement. Throughout the retirement term, withdrawals are permitted tax-free. In QB, this configuration can be completed, after which the employers can begin making the required contributions. It is a known fact that 401k is nothing but a retirement savings plan.

Since the forfeited amounts were deducted when they were originally contributed , they are not deducted a second time when allocated from the forfeiture account. Creating and running the above 17 reports in QuickBooks Online is just as easy as many other functions. As long as you have processed payroll in QuickBooks at least once, you’ll be able to create and run payroll reports.

Our error free add-on enables you to focus on your work and boost productivity. It’s really very difficult to keep your risk in mind when you investing in your 401. Bonds and other fixed-income investments are safer than stocks, which are normally the riskiest type of investment. Generally, it is advisable to invest in riskier securities while you are young and to gradually reduce your exposure as you get closer to retirement. To calculate the proportion of your 401 that should be invested in stocks, a general rule of thumb is to subtract your age from 110.

Some smaller businesses are unable to afford official retirement plans, so it is up to their employees to find one themselves. Form W-2 must include information about the contributions of you or your staff members in order to make the retirement plan. Make sure the retirement contributions are included in your employees’ paychecks the next time you pay them. People could look for the best saving choice while making retirement plans. Going with the QuickBooks 401k plan in this case can be wise.

Now, manual setting up 401k in QuickBooks’ this particular version will be completed. As the above method works on the manual process, you can customize it as per your requirements. The company in question is a client of a contact of mine. I have no idea what the plan docs say but they seem to. I’ll underscore they should investigate the plan docs first.

So all you have to do is reduce the liability when Guideline withdraws the money from your account. I did have help on the third call with Jack at QBO – great advisor – who found the liability accounts for me. Hope this helps someone else if they are going down this rabbit hole. Guideline and QBO should be able to tell clients that a liability account has been created. It is also important for top-heavy plans to be aware that the allocation of forfeitures can trigger the top-heavy minimum contribution if key employees share in the allocation.

The SEP IRA contribution is not required to be recorded in Gusto but needs to be recorded in your accounting software. Exempt from FICA/Medicare/FUTA/Federal Withholding. You can see the affect of your change by reviewing the W-2 and payroll summary report and drilling down on the tax items.